22

تشرين الأولInvesting In Gold Is The Neatest Thing You can do For your Retirement

No contributions can be made to such a inherited IRA, and the account can't be rolled over into other IRA. If you have any sort of questions regarding where and ways to make use of is a gold ira a good investment, you could contact us at our web-page. These sanctioned custodians and directors of the valuable metals IRAs typically cost a processing charge so as to start the account opening for these self directed IRAs. With a lump sum distribution, you receive all the money in your account without delay. Your cash will continue to be tax deferred until you withdraw. Whereas a beneficiary Particular person Retirement Account (IRA) has the same basic tax advantages of a traditional IRA, there are very totally different rules regarding the handling of beneficiary accounts. As said above, if you withdraw funds earlier than the age of 59-1/2, you pays revenue tax on that quantity plus a 10% early withdrawal penalty. Required Minimal Distributions (RMDs) are calculated primarily based on your life expectancy and will improve your taxable revenue within the year of withdrawal. In case you withdraw funds earlier than you attain age 59½, you may be subject to a 10% early withdrawal penalty. AHG has labored with some of finest custodians/depositories who are fast to reach your assets and take good care of them.

No contributions can be made to such a inherited IRA, and the account can't be rolled over into other IRA. If you have any sort of questions regarding where and ways to make use of is a gold ira a good investment, you could contact us at our web-page. These sanctioned custodians and directors of the valuable metals IRAs typically cost a processing charge so as to start the account opening for these self directed IRAs. With a lump sum distribution, you receive all the money in your account without delay. Your cash will continue to be tax deferred until you withdraw. Whereas a beneficiary Particular person Retirement Account (IRA) has the same basic tax advantages of a traditional IRA, there are very totally different rules regarding the handling of beneficiary accounts. As said above, if you withdraw funds earlier than the age of 59-1/2, you pays revenue tax on that quantity plus a 10% early withdrawal penalty. Required Minimal Distributions (RMDs) are calculated primarily based on your life expectancy and will improve your taxable revenue within the year of withdrawal. In case you withdraw funds earlier than you attain age 59½, you may be subject to a 10% early withdrawal penalty. AHG has labored with some of finest custodians/depositories who are fast to reach your assets and take good care of them.

How lengthy does it take to complete an IRA rollover? Once more, fees could range primarily based on which depository is used. The charges themselves will rely on the actual depository you choose ultimately. The Syrian defence ministry mentioned an air defence site in the south of Syria had been hit by an Israeli missile in the early hours of Friday morning local time. SOFI RESERVES The right To switch OR DISCONTINUE Products AND Benefits AT ANY TIME With out Notice. They are, and there are a number of advantages to investing in valuable metals by means of an IRA. Advantages embrace better management of property, consolidation and entry to raised and cheaper funds. The overwhelming majority of IRA custodians will assess these charges for any funds that you just require them to wire to you, or which they must wire to a coin/bullion vendor or depository in your behalf. After enrollment, you'll rollover current IRA or 401(k) funds or financial institution wire new funds to GoldStar. As such, the spouse beneficiary is allowed to make contributions, take distributions, rollover assets and in any other case deal with the account as if he had all the time owned it.

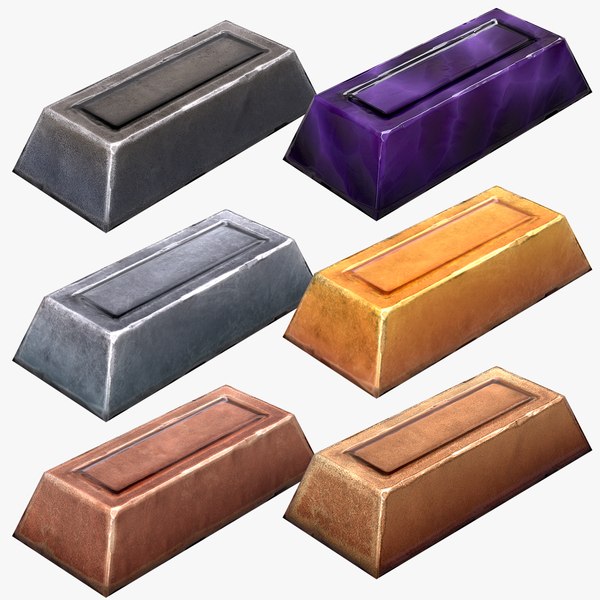

The excellent news is that there aren't any authorities sanctioned rollover or switch fees to maneuver over an existing conventional IRA to a precious metals IRA account. Traders even have the option of trading a portion to purchase bonds from authorities agencies or personal companies. The UK government mentioned it wouldn't speculate on the strike, however mentioned Israel should keep away from "significant escalation" while exercising its "proper to self-defence". Bullion corporations can give you advice when you will have questions like, "are precious metals IRA eligible." We recommend shopping round before you settle on the appropriate custodian. Choosing the proper IRA custodian will be tricky. For a partner selecting to treat the inherited IRA as his own, necessary distributions usually are not required until he reaches age 72. Nonetheless, withdrawals taken earlier than the age of fifty nine 1/2 are topic to a 10 p.c IRS penalty, a penalty which is waived for non-spousal beneficiaries. A non-spousal beneficiary doesn't have the choice to deal with an inherited IRA account as his personal.

مراجعات